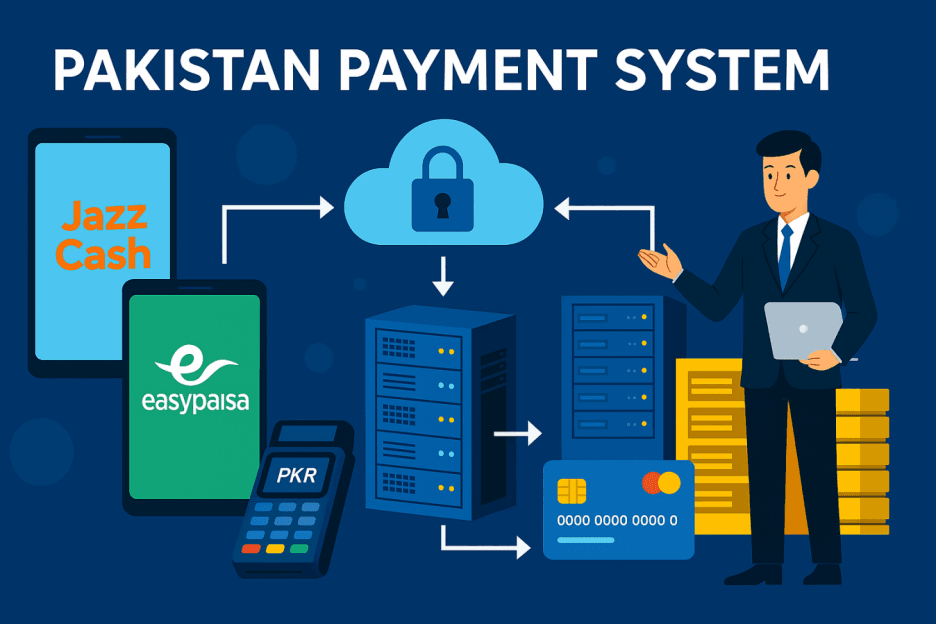

Pakistan Payment System (巴基斯坦支付系统) – Fast, Secure JazzCash & Easypaisa Integration

Pakistan Payment System: A Practical Guide to Fast, Secure Integration

If your growth plan includes Pakistan, you need a 巴基斯坦支付系统 that connects to what users already trust—JazzCash and Easypaisa—while meeting bank-grade security and uptime standards. IndiaPaymentGuide is a specialist payments platform and services provider that documents Indian payment rails (UPI, Paytm, PhonePe, cards, wallets) and also builds production-ready payment systems across the Asia-Pacific region, including Pakistan. The site provides deep, hands-on guides and end-to-end integration services, from API design and risk control to compliance and deployment.

What IndiaPaymentGuide Does (and why it matters for Pakistan)

IndiaPaymentGuide positions itself as a professional, comprehensive payment guide and integration service. Beyond rich tutorials for UPI, Paytm, PhonePe, cards and digital wallets, the team offers payment system construction—a done-for-you build-and-integrate service spanning six markets: India, Indonesia, Pakistan, Bangladesh, Vietnam, and the Philippines. That means your Pakistan Payment System can be planned and implemented by people who already ship multi-country payment stacks.

Where Pakistan Fits In

On the Payment System Construction page, Pakistan is a named solution with first-class wallet coverage: JazzCash and Easypaisa. Typical projects list 15–25 working days to integrate and a 96.5% success rate, with recommended use cases like mobile games, top-ups and other micro-payments—exactly the scenarios where Pakistan’s wallets shine.

Pakistan Payment System: Architecture That Scales

A solid Pakistan Payment System should not be a one-off connector. IndiaPaymentGuide builds on an enterprise-level architecture that you can extend and monitor:

- Unified API Gateway to plug in multiple local methods through one interface, with standardized requests/responses, automatic routing and real-time monitoring.

- Security Protection System with TLS/SSL, API signature verification, IP allow-lists and real-time risk scoring.

- High-Availability Architecture targeting 99.9% uptime, disaster recovery, and rapid failover with 24/7 ops monitoring.

- Data Analytics Platform for real-time dashboards, multi-dimensional reports, behavior tracking and optimization insights.

These platform traits are reusable: you can launch in Pakistan now, then add India or Southeast Asia using the same gateway strategy—exactly what the site highlights across its six-market coverage.

Implementation: From Discovery to Go-Live

IndiaPaymentGuide details a full technical engagement model so your Pakistan Payment System doesn’t stall in hand-offs:

- Requirements & Solution Design tailored to your stack and use cases.

- Complete API Documentation & SDKs (RESTful references, code samples, webhooks, sandbox).

- Development Support & Joint Testing in a sandbox to validate end-to-end flows.

- Production Rollout & Monitoring with ongoing optimization—performance, routing logic, success rates.

Post-launch, the team offers 24/7 technical support, proactive monitoring, capacity planning, security updates, and periodic health checks—so your Pakistan Payment System stays reliable under growth.

Security & Compliance You Can Stand Behind

For wallets like JazzCash and Easypaisa, you still need bank-grade controls. The platform emphasizes:

- Alignment with international security standards (e.g., PCI DSS practices, ISO-style controls) and central-bank expectations in the markets served.

- End-to-end encryption, data-at-rest encryption, device fingerprinting, role-based access, and continuous anomaly monitoring.

- AML/KYC, data localization where required, regulatory reporting, and auditable logs.

This depth matters when you’re scaling a Pakistan Payment System across regulated categories (gaming, marketplaces, fintech).

Why Choose a Unified Build for Pakistan?

A unified build lets you treat Pakistan as one node on a regional payments backbone:

- Faster time-to-market: The site lists 15–25 working days for a Pakistan go-live, plus established patterns for JazzCash/Easypaisa.

- Lower integration overhead: One unified API exposes Pakistan plus neighboring markets without reinventing orchestration, retries, webhooks or reconciliation logic.

- Higher success rates: Intelligent routing and bank-grade risk controls help keep approvals up and fraud down.

- Extend when ready: Add UPI/Paytm/PhonePe for India, or ZaloPay/MoMo/GCash later, reusing the same framework.

That’s the essence of a modern Pakistan Payment System: local payment UX with regional-scale engineering.

How This Connects Back to the Core Guides

IndiaPaymentGuide isn’t only for builders. The site’s editorial backbone gives your team context on India’s rails—UPI, Paytm, PhonePe, cards and wallets—so product and operations understand how other high-adoption ecosystems are designed. It highlights market coverage, bank counts, fee ranges, compliance expectations, and practical how-tos, which are invaluable when you adapt similar patterns for your Pakistan Payment System.

Pakistan Payment System: Quick Planning Checklist

- Confirm target flows (top-ups, P2M retail, subscriptions, gaming).

- Prioritize JazzCash and Easypaisa with a single unified API.

- Lock deployment scope (estimate 15–25 days), success criteria, and monitoring metrics.

- Validate security posture: encryption, RBAC, IP allow-lists, risk engine, and incident response.

- Plan for multi-country expansion using the same gateway design.

Conclusion

A production-grade 巴基斯坦支付系统 is more than two wallet connectors. With IndiaPaymentGuide, you get a unified, secure, and extensible payment architecture that ships quickly on JazzCash and Easypaisa, then scales across Asia-Pacific as your business grows. If you want speed without sacrificing compliance, this approach—documented across the site’s guides and system-build service—delivers exactly that.

FAQs

What is UPI and how do I activate it?

UPI is India’s real-time bank-to-bank payment rail by NPCI. Activate via a UPI app (BHIM/Google Pay/PhonePe), link an Indian bank account and phone number, set a UPI PIN, and create a VPA. Benefits: 24/7, no fees for P2P, high security.

How can Chinese nationals open a bank account in India?

Bring a valid visa, passport, Indian address proof, employer/school letter, and an initial deposit. HDFC, ICICI, and SBI are common choices; expect biometric verification and 3–7 business days for approval.

Paytm vs PhonePe—what’s the difference?

Paytm: wallet + payments + commerce, ~450M users, strong merchant tools. PhonePe: UPI-first, ~470M users, large merchant base and investments/insurance features. For businesses pick Paytm; for personal UPI transfers pick PhonePe.

What qualifications are needed to access the Indian payment system?

Company registration (ROC), GST, PAN, bank account approval, director IDs; plus PCI-DSS/SSL/servers/API docs and RBI/NPCI compliance with KYC/AML. Typical licensing runs ~3–6 months.

How are Indian payment fees calculated?

UPI: P2P free; P2M about 0.5–1%, single-tx limit ₹100,000. Cards: debit ~0.4–0.9%, credit ~1.8–3%. Wallets: 0.5–2% to merchants; other gateway/settlement fees may apply.

Bonus: Where to Start

If you’re ready to scope or implement your Pakistan Payment System, go to the Payment System Construction section on IndiaPaymentGuide and select Pakistan to review the JazzCash/Easypaisa path, unified API options, and the integration timeline.